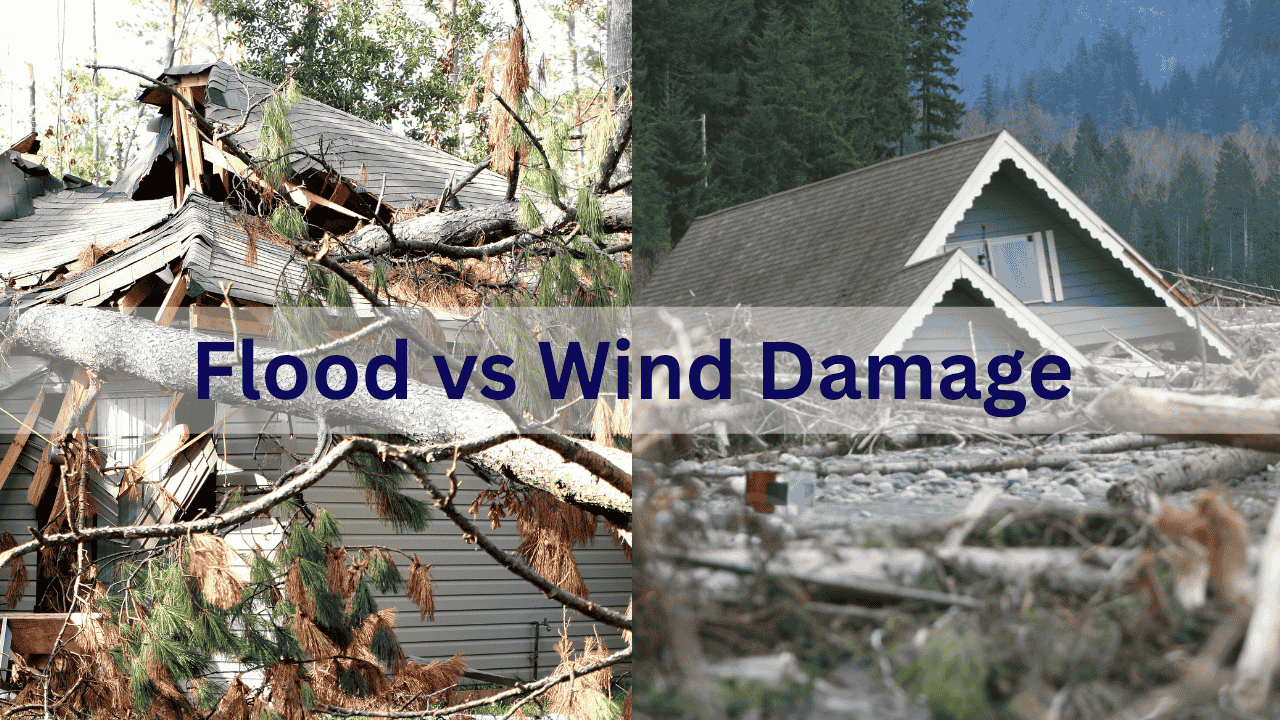

Do you know the difference between flood and wind damage in your insurance coverage?

When storms and hurricanes hit, they often bring powerful winds and heavy rains, leading to various property damage. Understanding how your insurance policy distinguishes between flood and wind damage is crucial, as it impacts your claims process and what you may ultimately receive. Many homeowners are surprised to learn that standard insurance policies cover wind damage but often exclude flood damage, which typically requires a separate policy. In this guide, we’ll break down the differences in flood and wind damage coverage, helping you navigate the process and ensuring you know exactly what to expect when filing claims.

Understanding Flood vs. Wind Damage Coverage

Insurance companies treat flood and wind damage as separate types of losses. Here’s a look at each:

Flood Damage Coverage

Flood damage typically refers to water damage caused by external flooding, such as rising waters from heavy rain, overflowing rivers, or storm surges. Unfortunately, standard homeowners insurance policies do not cover flood damage. Homeowners who want protection from flood damage need to purchase a separate flood insurance policy, often through the National Flood Insurance Program (NFIP) or a private insurer. This policy covers damage to your home’s structure and, in some cases, your belongings within the home.

Wind Damage Coverage

On the other hand, most standard homeowners insurance policies cover wind damage. Wind damage includes destruction caused by high winds, such as broken windows, roof damage, or fallen trees. Coverage for wind damage is usually comprehensive, helping to repair structural damage, replace personal property, and cover temporary living expenses if your home is uninhabitable. However, policies can vary, and in areas prone to hurricanes or tornadoes, some policies may have higher deductibles for wind-related claims.

Navigating Your Coverage and Filing Claims

Understanding what’s covered in your policy is the beginning; navigating the claims process can be challenging. Here are a few steps to take:

Document the Damage

Start by photographing and recording all visible damage to your property, separating wind damage from flooding if both occur. Accurate documentation helps your adjuster understand the scope and nature of the damage.

Review Your Policy Details

Carefully read your policy to confirm what’s covered and identify any exclusions or special deductibles related to wind or flood damage. This will give you a clearer picture of the process and prevent surprises when filing.

File Separate Claims if Necessary

You may need to file separate wind and flood damage claims if you have flood and homeowners insurance policies. This is particularly important if both types of damage occurred in the same event, as your flood insurer may not cover wind damage, and vice versa.

Understand Deductibles and Coverage Limits

Policies for flood and wind damage often have distinct deductibles and coverage limits. Knowing these details can help you understand potential out-of-pocket costs and the timeline for processing each type of claim.

Consider Working with a Public Adjuster

To ensure you’re fully compensated, consider hiring a public adjuster. These professionals can advocate on your behalf, document damages, negotiate with insurers, and streamline the claims process.

FAQs

Does homeowners insurance cover flood damage?

No, standard homeowners insurance policies do not cover flood damage. To protect against floods, you’ll need a separate flood insurance policy, which can be purchased through the NFIP or a private insurer.

What’s the difference between flood and wind damage?

Flood damage typically involves rising water from external sources like rivers, heavy rainfall, or storm surges. In contrast, wind damage includes structural damage caused by high winds, such as roof or window damage.

How can I document wind or flood damage for my claim?

Photograph all damaged areas, including close-ups of specific items and broad shots of affected rooms or exterior areas. Note any areas where wind and water damage overlap, which may require separate claims.

Do I need separate insurance policies for flood and wind damage?

Yes, flood insurance and wind damage coverage are usually separate. Homeowners insurance typically covers wind damage, while flood insurance must be purchased separately to cover flood-related losses.

Can a public adjuster help with flood and wind damage claims?

Yes, a public adjuster can be invaluable in helping you maximize your claim. They’ll document damages, negotiate with your insurer, and guide you through filing flood and wind claims to ensure total compensation.

Need Help with Your Insurance Claim?

Dealing with flood and wind damage can be overwhelming, but you don’t have to navigate it alone. We’re here to connect you with experienced professionals specializing in insurance claims and can help ensure you receive the full coverage you’re entitled to. Reach out today to get the support you need to restore your home after a storm.